11 Mar 2020

Over the last few weeks, we have seen some frightening headlines and commentary emerge around Covid-19 (Coronavirus). Scaremongering, sensationalising, click bait, fake news, or do we have a reason to be concerned?

Call it what you like, I’d be lying if I said it hadn’t made me increase my hand sanitizing of late…….

However, I can’t help but wonder, if we’re currently living in a world of irrational fear. Consumers are ‘panic’ buying, face masks are emerging everywhere, media alerts and updates seemingly happen every half hour and the markets, here and overseas, are bouncing around.

Don’t get me wrong Coronavirus is clearly a unique bug, hence why it’s been referred to as the ‘novel’ Coronavirus outbreak. There’s a lot that health experts have to learn about it.

But this is not the first ‘novel’ virus outbreak and it won’t be the last. So why is there so much volatility (as reference in this Nasdaq article HERE) and fear? And when are things likely to calm down?

Looking back in history

If we look back in history, fear and market volatility occurred during the SARS and Swine Flu outbreaks in 2003 and 2009 too. And just as the markets did following the Asian Financial Crisis of 1998 and the Global Financial Crisis (GFC) in 2008/9, they bounced back following SARS and Swine Flu too.

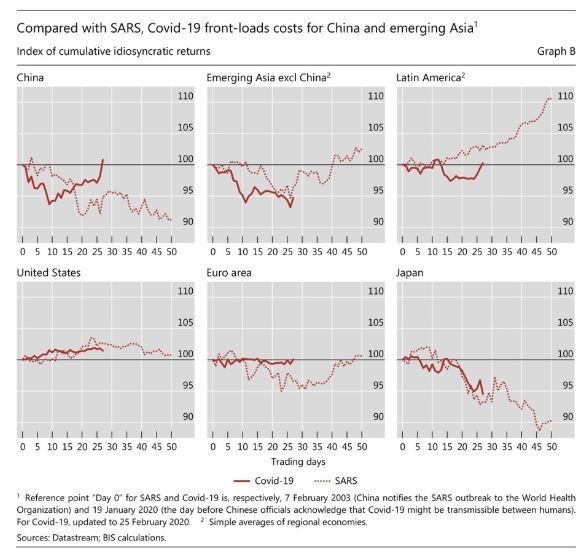

The graph below shows that so far Coronavirus caused a more immediate reaction in global markets with a faster drop, than they did during the SARS outbreak. What we see today is the market in China has headed upwards sooner.

Figure 1:Index of cumulative idiosyncratic returns [1]

What about investments and commercial property during volatile events?

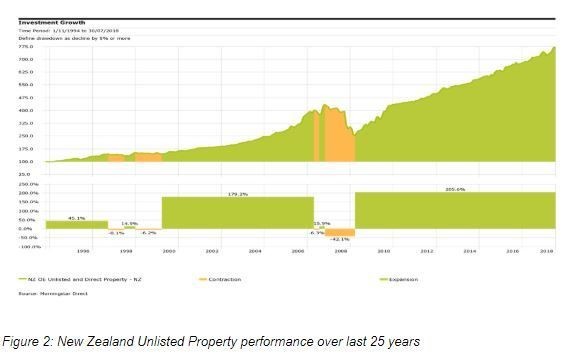

If you look at figure 2 below, you can see that during the GFC it took directly-held real estate assets only three years to fully recover its losses of value (approx. 40%).

We know equities, which lost the equivalent value, took six years, (twice as long) to recover to the pre-GFC level [2].

What we saw in 2008/9 is that investors gravitated back to tangible assets with easily identifiable revenue streams when markets are volatile and uncertain, just like we are seeing now.

Also looking at the Morningstar graph in figure 2, it shows if you had invested $100,000 25 years ago in directly-held NZ commercial property, the value of your investment now would be 7.75 times that at $775,000(2018)[3], despite living through the Global Financial Crisis, SARS and Swine Flu.

What about New Zealand and PMG?

New Zealand’s economy is in relatively good shape.

After the strong performance of the S&P/NZX50 Index (notching up a 30.4 per cent in 2019) the sentiment for some time has been that it was overpriced and was expected to cool down. So perhaps coronavirus might have kick-started this in New Zealand, but arguably, the recent sell off we’ve seen was overdue anyway.

As I write, March 10, the NZX has bounced around today and I’m sure it will continue to bounce around tomorrow. Its what markets do when there is uncertainty or fear. Investors, companies, and people react.

This volatility is precisely why PMG is focused on providing solid, diversified and unlisted investments, underpinned by the security of land and buildings, for the long term. Our unlisted commercial property funds have been specifically set up to weather whatever economic, geopolitical or biological event occurs.

The value of our funds is underpinned by real tangible New Zealand assets, they are less subjected to market sentiment, and irrational fear. They provide idiosyncratic returns – or returns based on the merit of the assets (properties) in the fund not on market surges. PMG funds also carry a conservative debt to equity ratio, ensuring our funds are not beholden to the banks.

What do we think will happen next?

Due to New Zealand’s property and economic fundamentals, historically low interest rates, which thanks to coronavirus are likely to go lower, and the relative performance of New Zealand's commercial property, (especially directly-held property), there is still a weight of money, within New Zealand and from offshore capital, looking for a home in New Zealand.

(In the last 5 years 50% ($13.8b) of all NZ commercial property transactions over $20M were from offshore investors.[4])

China’s manufacturing sector is beginning to come back on-line. New Zealand businesses will experience disruption but thrive in the long term. My view is that New Zealand’s commercial property sector, land and buildings will remain an attractive asset class for investors.

After 27 years as a property funds manager, PMG has traversed through a number of economic cycles and natural events.

Our strategy has always been about providing our investors with a defensive investment focused around cash flow and yield (regular returns). Our strategy will remain steadfast.

In the storm, look for the calm.

Scott McKenzie

DISCLAIMER

[1] https://www.bis.org/publ/qtrpdf/r_qt2003w.htm

[3] https://www.pmgfunds.co.nz/unlisted-commercial-property-stands-test-of-time

[4] www.bayleys.co.nz

Content of the article is the opinion of Scott McKenzie and is not intended as personalised financial advice. You should seek independent financial advice from an authorised financial advisor before making any investment decisions.

Prospective investors are recommended to seek professional advice from an authorised financial adviser which takes into account their personal circumstances before making any investment decision. The Investor Relationship Team do not provide personalised advice. No person may offer, invite any units or distribute any documents (including a Product Disclosure Statement) to any person outside New Zealand without the approval of PMG.